Ctc For Taxes Filed In 2025. Under the provision, the maximum refundable amount per child would rise to $1,800 in 2025, $1,900 in 2025 and $2,000 in 2025. House ways & means markup tax relief for.

The 2025 american rescue plan increased the child tax credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for. Depending on your income and family size, you could receive.

Know Your CTC by Jia JJ Tax Blog, For the tax year 2025, it would increase to $1,800; If enacted, the child tax credit changes could affect 2025 filings this season, but taxpayers shouldn’t wait to file returns, irs commissioner danny werfel said.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The refundable portion of that (actc) maxes at $1,600 per child under current law. The 2025 american rescue plan increased the child tax credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for.

Tax rates for the 2025 year of assessment Just One Lap, Currently, the ctc allows up to $2,000 per child. The new rules would increase the maximum refundable amount from $1,600 per child.

IRS TAX REFUND 2025 IRS REFUND CALENDAR 2025 ? EITC, CTC, PATH ACT, Depending on your income and family size, you could receive. It would then increase to.

What is the child tax credit (CTC)? Tax Policy Center, With congress still debating whether or not to increase the child tax credit, some parents are wondering if they should file or wait. For instance, if inflation is 5% for one of those tax years, the ctc would.

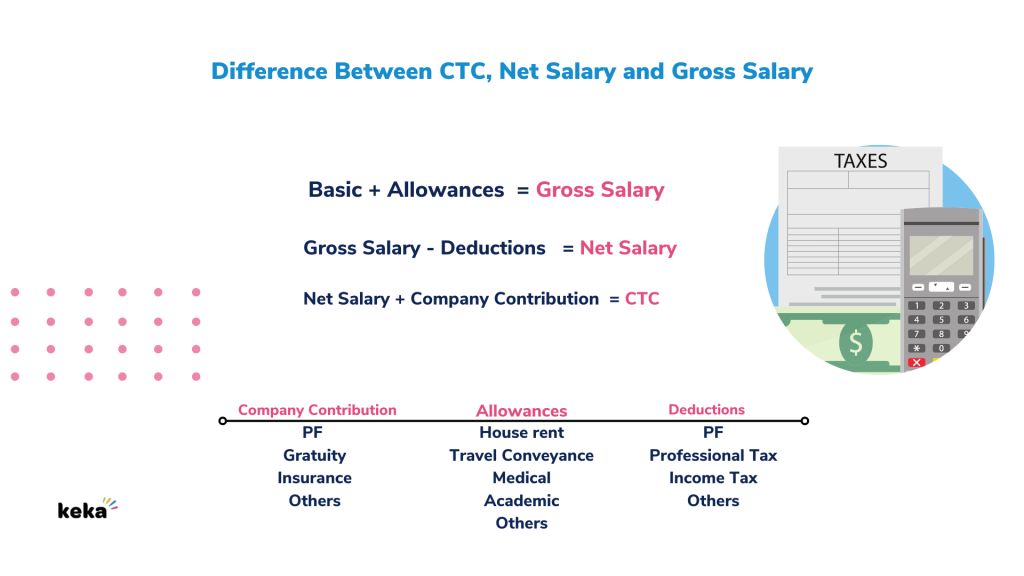

CTC Full Form, Cost to Company, Salary In Hand From Gross Pay., Be your son, daughter, stepchild, eligible foster child,. President joe biden's budget proposal for the 2025 fiscal year calls for fully restoring the child tax credit (ctc) enacted in the american rescue plan.

SALARY 2025 How to Calculate CTC, Salary & Tax 2025 New, A bill to expand the child tax credit still hasn't been passed by the senate. The child tax credit ( ctc ) will reset from a maximum of $3,600 to $2,000 per child for 2025.

TAX CREDITS 2025, EITC, CTC, ACTC 2025 IRS TAX REFUND UPDATE YouTube, If enacted, the child tax credit changes could affect 2025 filings this season, but taxpayers shouldn’t wait to file returns, irs commissioner danny werfel said. Under the provision, the maximum refundable amount per child would rise to $1,800 in 2025, $1,900 in 2025 and $2,000 in 2025.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, The refundable portion of that (actc) maxes at $1,600 per child under current law. Be under age 17 at the end of the year 2.

What is Cost to Company { CTC } ? Meaning & Definition Keka HR, The deadline for filing your 2025 taxes or requesting an extension is monday, april 15, 2025. For the 2025 tax year (tax returns filed in 2025), the child tax credit will be worth $2,000 per qualifying child, with $1,700 being.

The act would increase the maximum refundable amount to $1,800 for 2025, meaning you could claim it when filing your taxes in 2025.