Nys Income Tax Rates 2025. This page has the latest new york brackets and tax rates, plus a new york income tax calculator. You’ll see, they are grouped by two.

2025 Federal Tax Brackets Nani Tamara, New york state income tax calculation: New york's 2025 income tax ranges from 4% to 10.9%.

Fact Check New York has the highest taxes, There are nine tax brackets ranging from 4% to 10.9%. State income tax rates can raise your tax bill.

How High are Tax Rates in Your State? Your Survival Guy, There are nine tax brackets ranging from 4% to 10.9%. New york city income tax rates vary from 3.078% to 3.876% of individuals’ new york adjusted gross income, depending on your tax bracket and what status you.

When Does Taxes Start 2025 April Brietta, The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been officially released. New york's 2025 income tax ranges from 4% to 10.9%.

2025 Federal Tax Tables Janaye Sherill, There are currently nine tax brackets in. Learn more using the tables below.

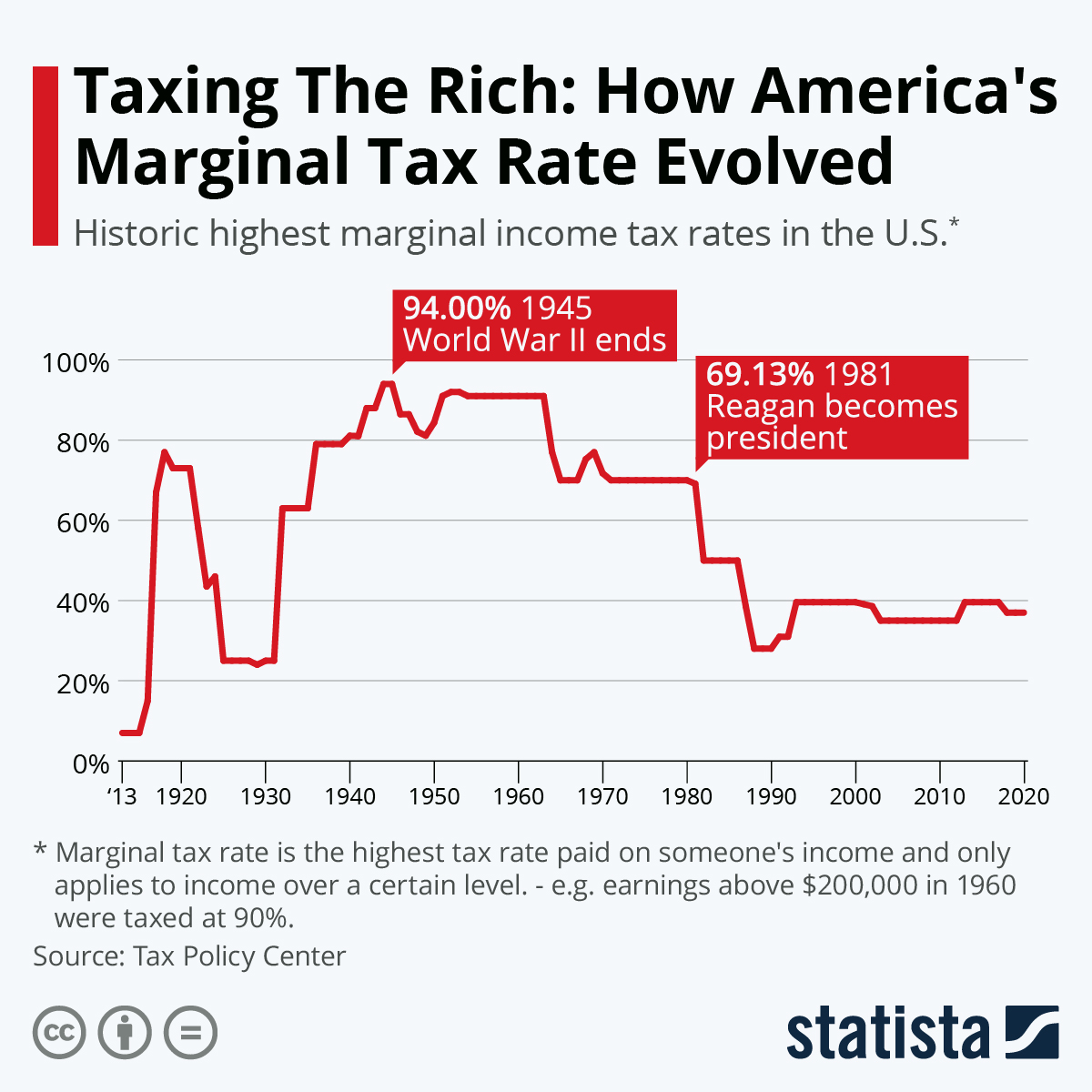

Chart Taxing The Rich How America's Marginal Tax Rate Evolved Statista, $1,616,450 (filing as head of. Ny tax rates vary between 4% and 8.82%, depending on your filing status and adjusted gross income.

Nys Capital Gains Tax Rate 2025 Helli Krystal, New york state has a progressive income tax system, which means that the more income you earn, the higher your tax rate. There are currently nine tax brackets in.

Tax Rates 2025 2025 Image to u, There are currently nine tax brackets in. This page has the latest new york brackets and tax rates, plus a new york income tax calculator.

Top State Tax Rates for All 50 States Chris Banescu, $1,616,450 (filing as head of. Tax brackets and rates depend on taxable income, adjusted gross income and filing status.

Personal tax, New york has a graduated corporate income tax, with rates ranging from 6.5 percent to 7.25 percent. $1,616,450 (filing as head of.

For tax years beginning on or after 2028, the top state personal income tax rate decreases to 8.82% for income over $2,155,350 (married filing joint);